Low Inventory Still Causing Record Low Sales

April 18, 2015 by Laura Duggan · Leave a Comment

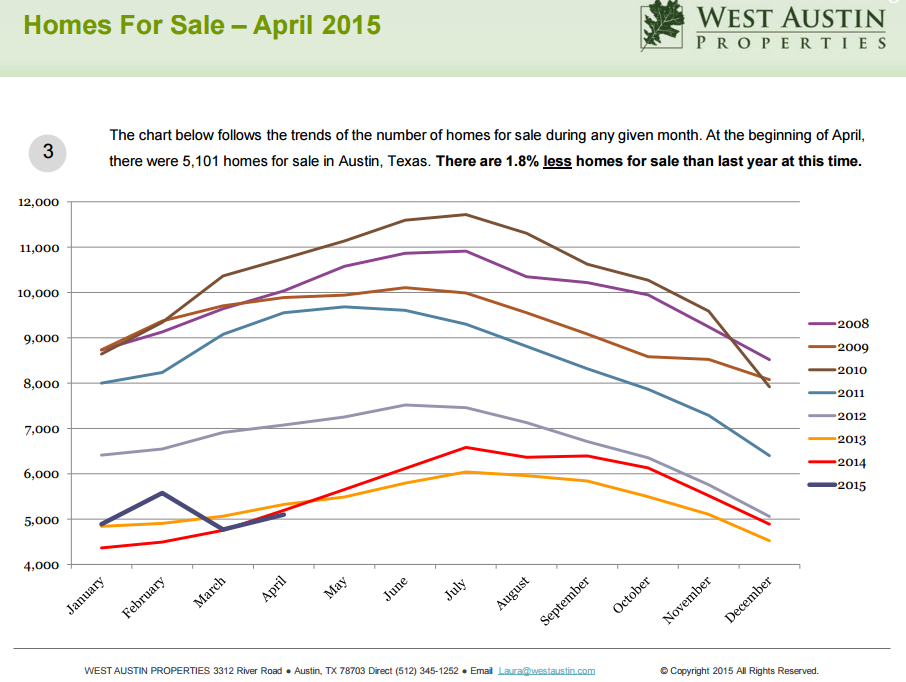

The Austin housing market is experiencing a crisis of sorts as we ride into the Spring selling season, typically the most active time in our market. Record low inventory is wreaking havoc in our market as population growth and demand in Austin outpace the number of available properties.

Buyers are fighting for properties in almost all price segments with entry level buyers and those seeking a mortgage being the biggest losers in the fray. It is not only common, but the rule right now that there are multiple offers, sales over list price and days on the market limited to the number of days the listing agent is holding the property before submitting “final and best” offers to the seller.

It is indeed a great time to be a seller. And, its a really stressful time to be a buyer. If you are a seller in today’s market, chances are you are either moving to assisted living or out of the city. Why? Because sellers who are also moving up in price or downsizing are disappointed in the prices they would have to pay to move within the city. There are few quality choices for sellers who want to remain, and the competition for what is available is so stiff that few want to jump into market. And, most sellers right now either have a low mortgage payment and interest rate at or below 4% so they aren’t motivated to move.

What does that mean for Austin? Short term it means that prices will continue to increase as demand keeps fueling them upward. It also means that our entry level buyers are having to move farther and farther out into the suburbs. Prices have risen over 16% in the last year.

Forbes recently called Austin the #1 city for overall tech and job creation over the past decade. People are moving here because of our quality of life and business friendly tax situation. I just wonder how long we can sustain the character of the city that I’ve loved and enjoyed since childhood.

Yes, real estate is cyclical. I’ve seen it up and I’ve seen it down and every where in between since I began my real estate career in 1979. The cycles generally run in 10 year cycles. We began tracking the market statistics monthly in 2006 and saw the last downturn before most. Every month we publish a comprehensive real estate market report so we can follow the trends and predict the cycle for the next quarter. Take a look at our April Market Report. You can find all of these market reports at WestAustin.com

If you’re a buyer right now, be patient. The market will loosen. If you’re thinking of selling, now is the best time I’ve seen since 2006 to maximize your tax free equity. Remember that a married couple can take $500,000 equity out of their primary residence tax free.

Real estate will always be local and fluctuates by neighborhood. We are happy to give you a personal assessment of your home or help you find the best property.

Submitted by Laura Duggan, West Austin Properties, 3312 River Road, Austin, Texas 78703; 512-750-2425; laura@westaustin.com

March Real Estate Market Report

March 16, 2015 by Laura Duggan · Leave a Comment

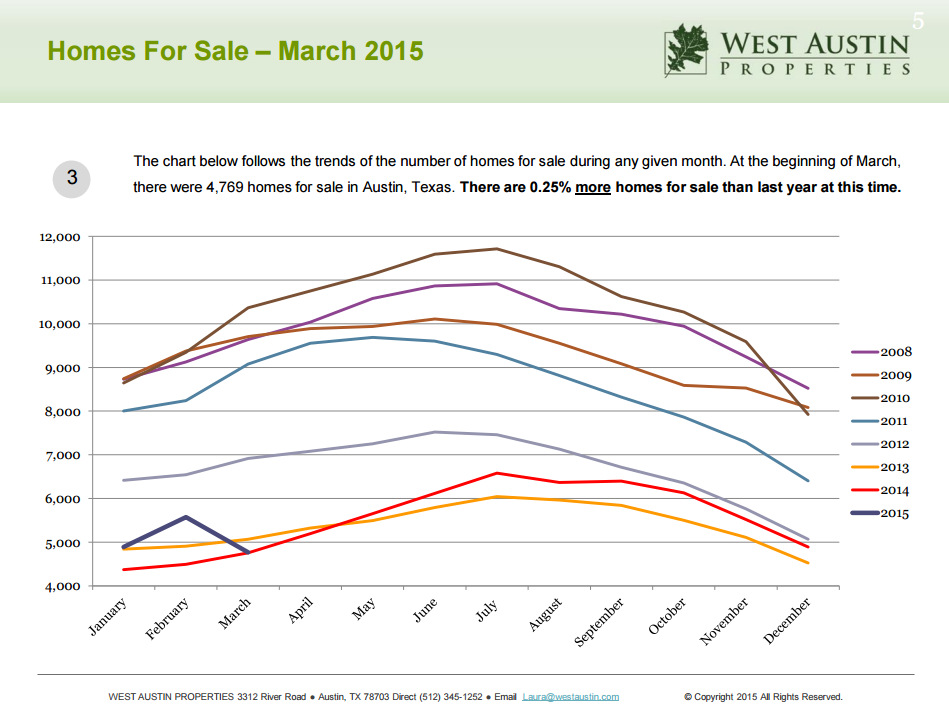

Spring is here in Central Texas, and the real estate market in Austin is already in full swing. Home sales in January and February exceeded those in the same time period for the last seven years. With still fewer than 5000 single family homes actively on the market, demand is still outpacing the supply.

March began with the highest number of pending home sales in history with 3,466 pending home sales. I had to take a double look at that figure just to make sure it was right. Both the inventory and days on market are at record lows. Of course it varies by neighborhood and price range, but the average days on market is 48. Increasing demand and low inventory continues to push prices upward. Take a look at the specifics for each price band and zip code in our March Market Report.

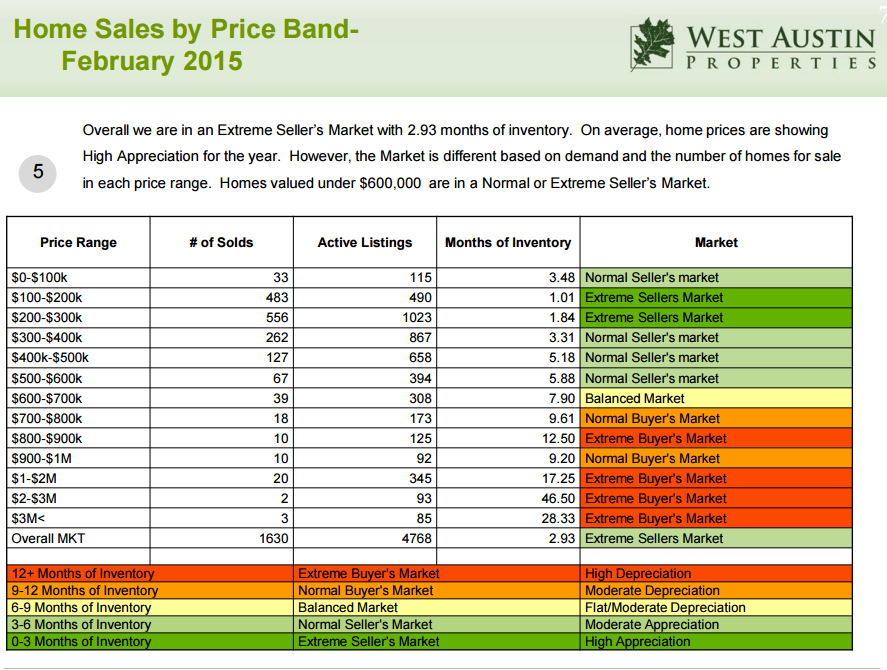

The strongest demand is still for homes under $600,000. All of the price bands under $600,000 are in an Extreme to Normal Seller’s Market.

In the luxury market, those homes priced at or above $1,000,000, a good number of sales are going unreported. We belong to several luxury agent networking groups that share properties that are being sold in the “silent” market or that will never appear in the MLS for a number of reasons. We have the opportunity to tour these homes privately and to showcase our listings with these luxury home groups. The majority of the buyers purchasing these homes are paying cash for them, and we are still seeing multiple offers on these properties even though they are being offered publicly. Our excellent contacts in the real estate industry help us stay ahead of the curve by networking with these luxury agents. It continues to be a big win for our buyers and sellers.

Real estate is hyper local and all of us are Austin natives. If you have questions about the specific data in any neighborhood, we are happy to help you understand what is happening there.

Posted by Laura Duggan, President, West Austin Properties, 3312 River Road, Austin, Texas 78703, 512-750-2425, laura@westaustin.com

Austin Real Estate Market Report for February 2015

February 16, 2015 by Laura Duggan · Leave a Comment

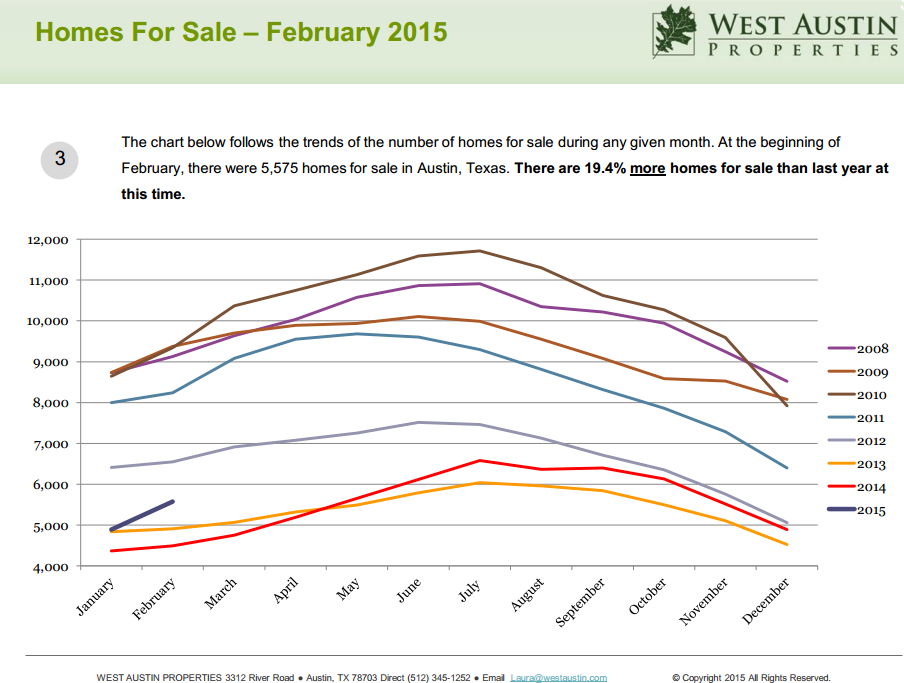

The Austin real estate market started 2015 with higher listing inventory, higher pending sales and higher home sales than this time last year. With 19.4% more of homes on the market this year than last year at this time, this is good news for many home buyers who’ve been competing with multiple offers and rising prices. If inventory continues to increase, this could mean more good news for buyers as prices may stabilize after the usual spring surge in home sales.

Pending home sales are also higher as the number of buyers in the market are absorbing the inventory. In fact, we had the highest number of January pending home sales in 7 years. New appraisal rules that went into effect at the end of January may increase the time that it takes to get mortgage approvals. If that happens, homes may stay pending longer prior to closing and cause this pending home sales number to increase more than normal.

January home sales are also up over the same time last year, again the highest number in 7 years at just over 1400 sales out of a 4813 market inventory of single family homes. That means that there is 3.42 months of inventory available. Generally, 3-6 months of inventory is considered a seller’s market. The lower the inventory, the more the seller has the advantage and we have appreciating prices.

To see all of the statistics in the Austin real estate market in January, take a look at the full report where we have the statistics outlined by price band and zip code. We are also happy to give you a complete assessment of your home’s value in our market.

Posted by Laura Duggan, President, West Austin Properties, 3312 River Road, Austin, Texas, 78703, homes@westaustin.com

Austin Real Estate Market Still Brisk in 2015

January 15, 2015 by Laura Duggan · Leave a Comment

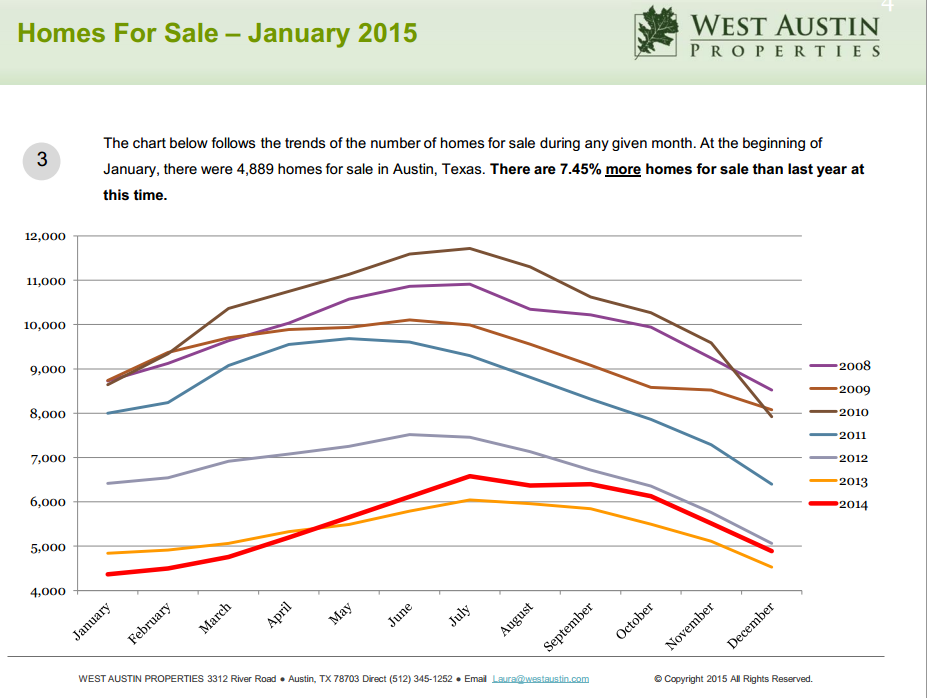

The Austin real estate market continues to be one of the healthiest in the country. Our January Market Report, a compilation of last year’s numbers, shows the statistics by price range and zip code so you can check out your particular neighborhood and price range. Although there are 7.45% more homes on the market now than last year at this time, the inventory of homes is still slim and real estate agents all over town are scratching to find good listings for their buyer clients. Now we have just under 5000 homes on the market compared to the 9000 homes we had on the market at the end of the years 2008-2010. Consider that we now have 1.8M people in our area, so the pressure continues to build on the housing market here. Home prices and rents are still rising with the demand.

In his annual forecast, Angelo Angelou, a local economist with AngelouEconomics, reported that 66,000 people moved to Austin in 2014 and that 39,100 jobs were created primarily in the professional and business service sectors, and the hospitality industry behind that. He projected that Austin will add 69,400 new jobs in 2015 and 2016. Even though housing prices are up, the average cost being almost $300,000, our population and job growth are fueling the economy and driving the home market rather than creating a bubble once driven by speculation. However, water, traffic and affordability are issues that could dampen the outlook in the future.

In it’s recent post, Best Buy Cities: Where to Invest in Housing in 2015, Forbes.com called Austin the #1 city to invest in the housing market because of it’s population growth rate 0f 8.9% between 2010-2013, its 3.6 annual job growth rate and it’s vibrant tech scene.

As always, the real estate market is constantly changing. We continue to research the market each month and plot the statistics so that we can predict trends, helping our clients make the very best real estate decisions. You’ll find our Market Reports posted each month on our website at WestAustin.com

Katy Freshour, Gail Boston and I would like to wish you a very happy and healthy 2015. It would be our pleasure to assist you in any way with your real estate needs.

Posted by Laura Duggan, President, West Austin Properties, 3312 River Road, Austin, TX 78703, 512-750-2425, homes@westaustin.com