Protesting Your Tax Appraisal

May 6, 2010 by Katy Duggan · Leave a Comment

In the next few days you should get the 2010 Notice of Appraised Value for your property. It will come from the county tax office where your property is located so keep an eye out for it. The notice gives you the assessed value for the market value of the land and the improvements or structures on the property breaking out each amount. It also gives you last year’s value so you can see how much it has increased or decreased. Each taxing entity is also listed along with the exemption amount if you qualify for one and the tax rate. For example, I live in the City of Austin, so the tax entities are listed as

Austin, ISD

City of Austin

Travis County

Travis County Health Care District

Austin Community College

Each one lists the tax rate for last year and the estimated taxes I will pay this year. The lion’s share of tax goes to the school district with city and county making up the majority of the rest.

If you don’t agree with the assessed value, it is really important to file a protest with the county, and it is really easy to do. You have until June 1, 2010 to file a protest in writing with the county. On the back of the notice, fill in the reason you are making the protest by checking the appropriate box. You do not need to give them any more information, like what you think your home is worth at this time. Mail the form back with your signature.

You will be assigned a time for an informal hearing. Gather the data you need to justify your position. We can provide you with comparable sales that support your position if you need them. It really helps to have print outs about each house that you are comparing to yours. You property will be judged by size, location and quality. When you arrive, you will sign in and wait for your name to be called. A hearing officer who is a local appraiser with the county will call you back and meet with you. Ask to see what properties were used in their assessment. Many times the properties they have used aren’t comparable and you can point out the differences. Present your comparables. The appraiser will decide if your value should be lowered and make you an offer. You either sign it, or you are assigned to appear again at a formal hearing. Most of these are settled at the informal stage. I have saved property owners thousands of dollars over the years in these informal hearings by giving data that supported a reduction or correcting errors that the county had made in the property description itself. You just need to be prepared adequately. One homeowner was being assessed with a commercial value formula when his property was residential. His value was lowered substantially. So, don’t be afraid to protest your tax value. It may save you money short term and long term.

Leave us your comments and questions below. Have you ever gone through the protest process? What was your experience?

Filed under Home Buying, Home Selling, Real Estate Trends · Tagged with appeal, appraiser, assessment, comparables, county, data, hearing, home, homeowner, Laura Duggan, properties, Property tax, tax district, tax formula, tax rate, Travis County, value, West Austin Properties, Williamson County

Calculating Your Property Tax

May 6, 2010 by Katy Duggan · Leave a Comment

People often ask us how the property tax in Texas is figured. The county establishes a property value on January 1st . Assessments are mailed to property owners in April or May with a letter outlining the appeal process. Each tax district decides on a tax rate based on the revenue they need to operate, and those rates are combined into one over all tax rate. Because we have no state income tax in Texas, we fund many things from schools to city operations through property tax revenue. The formula is (Value X Rate = Property Tax). For example, if the tax rate is 2.5% and the value of your property is $200,000, then the tax for the property will be $5000.

There are also some tax exemptions that apply that can reduce the amount of tax that you pay. If you lived in your home on January 1st as your primary residence, you can apply for a Homestead Exemption. If you are 65 or older, you can also apply for another exemption. Keeping up with the value the county places on your home each year is important. You have the right to protest the value, and we have helped many friends and clients do just that over the years as a complimentary service. Even if you are over 65 years old, and your taxes have been frozen, the county still calculates a value and that value can increase each year. If you don’t protest that value, it will continue to rise as values increase.

Share your property tax stories, comments and questions with us in the comment section below.

Filed under Home Buying, Home Selling, Real Estate Trends · Tagged with appeal, assessment, exemptions, homestead exemption, Laura Duggan, Property tax, tax district, tax formula, tax rate, Travis County, value, West Austin Properties, Williamson County

Buying Power-How Far Will Your Dollar Go?

May 6, 2010 by Katy Duggan · Leave a Comment

Consider the value of interest rates. The difference of 1% can change what price range or neighborhood you can afford. Watch the video to find out more.

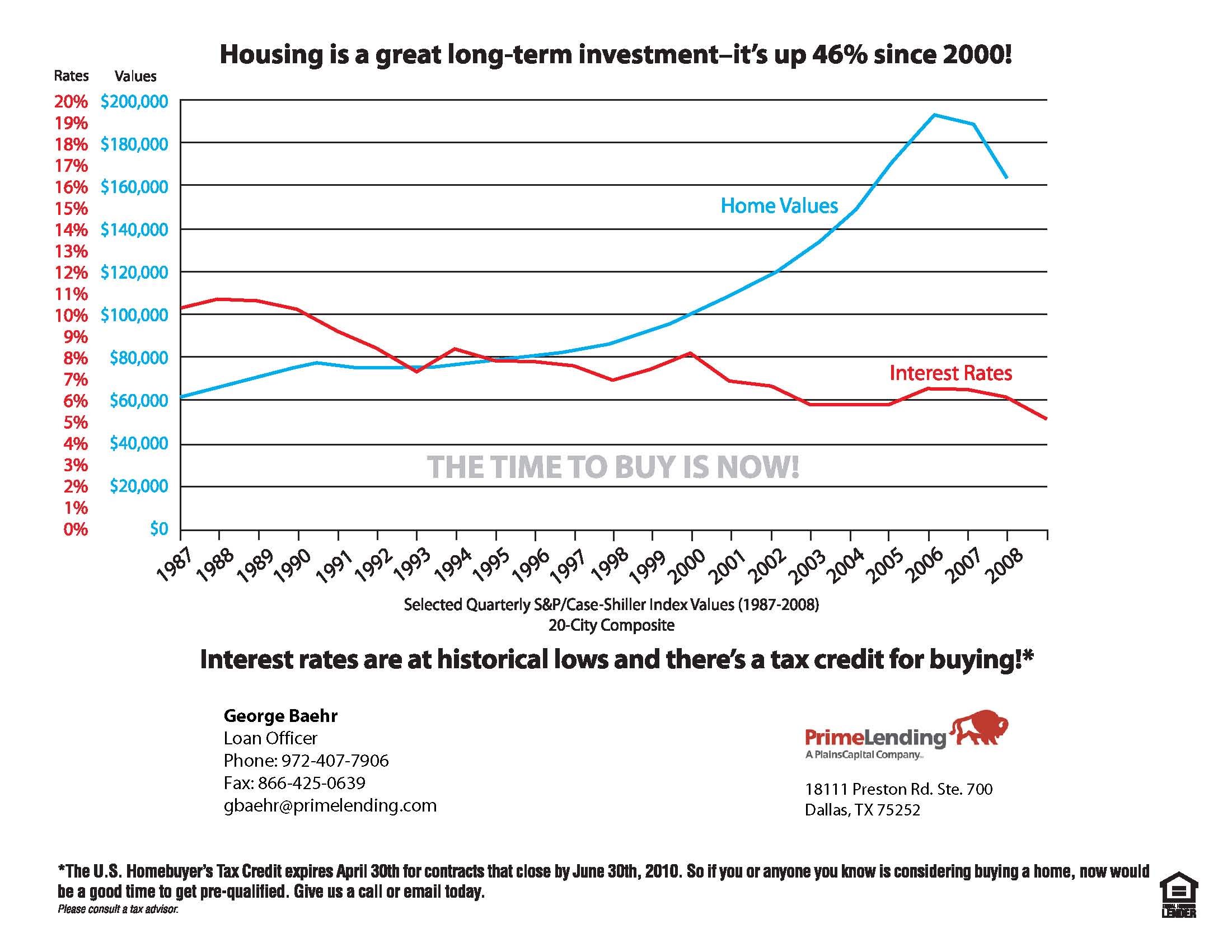

As you can see on the chart, the value of homes have consistently gone up over the past 20 years with a slight dip in the last 3 years. Interest rates have done just the opposite and consistently gone down. The difference between the two trends is a what we are calling “Buying Power.”

Filed under Home Buying, Real Estate Trends · Tagged with Austin, Interest Rates, Mortgage Loan, Patrick Birdsong, Real Estate, Texas, West Austin Properties

Buyer’s Market or Seller’s Market?

May 3, 2010 by West Austin Properties · Leave a Comment

By analyzing the number of homes available in any given price range or area you can determine whether you are in a buyer’s or seller’s market. Patrick explains the process. Sit back and watch this video to as Patrick will help you learn more!

Filed under Home Buying, Home Selling, Market Reports, Real Estate Trends · Tagged with