What do you know about the Austin Condo Market?

Wow! What a question. And no matter what type of client I work with–inevitably the conversation turns to this topic. Specifically, most people want to know who all those crazy people are living in those downtown condos. I always laugh at that remark because

I am one of those crazy people.

Most people see the price tag—the price per square foot and it makes their head spin. Then I mention that I live 100 yards from town lake and the trails, a 10 minute walk to some of the best restaurants and entertainment in Austin and a 5 minute drive to work. Not so bad.

And about 1,700 people agree with me when they purchased a condo last year. On top of that are 400-500 people who purchased a brand new condo in either The Spring, The Austonian or The Four Seasons Residences. Not one of these sales were recorded in the Austin-Central Texas Multiple Listing Service.

Watch the short video to get quick insight into Austin’s condo market. Then, download the market report below.

A friend and fellow Realtor sent me the below quote. Hope you enjoyed MLK Day!

Life’s most persistent message is, ‘What are you doing for others?’ – Martin Luther King, Jr.

Best,

Laura

Download Market Report

Of all types of Investors, the Move-Up Investor is the most near and dear to my heart wallet. All joking aside, I am one of the many Move-Up Investors out there. At one point in time, my rental property was my primary residence. Now, it is an income producing investment. The good news is that this is easily repeatable and savvy investors are doing it all the time.

In this post we will quickly discuss the characteristics of the Move-Up Investor, how to analyze your current home as an investment property and then find the deals out there for your next home.

Let’s first outline the characteristics of the Move-Up Investor.

The Move-Up Investor typically:

1. Has never owned an investment property. (You have to start somewhere!)

2. Owns a home that can be rented and cash flow.

3. Can qualify for a loan without selling their current property.

4. Can repeat the move-up strategy to build long-term wealth over time.

Analyze your current property as an investment property.

1. Begin by removing any emotional attachment to the property. Treat it as if it were a commodity, not a home. You have to be as objective as possible.

2. Figure out exactly how much it costs you to own this property. Payment, Taxes, Insurance (landlord, not homeowners).

3. Research current rents for the area and find the median rent, not the average. It is best to be as conservative as possible here.

4. Figure out cap rate and cash flow for your property. Use the below chart for some help.

Now comes the fun part. Let’s find you your next home!

The first conversation you need to have is with a lender. Figure out how much home you can afford without selling your current home. Remember, “Move-Up” Investor doesn’t mean you have to buy a bigger, more expensive house. I have a few clients who own multiple homes in the same neighborhood.

Take a look at a few of the properties below for move-up deals in our current market. (If we’re dreaming, we might as well dream big!)

Each property selected below is only an example of what’s available. Prices listed below are just asking prices. Estimated market value is based on comparable sales in the area and projections are deemed reliable, not guaranteed. The idea here is to purchase BELOW Market Value in a down market.

Filed under Home Buying, Real Estate Investing, Real Estate Trends · Tagged with Austin, buying, Foreclosures, Island at Mount Bonnell, Lake Austin Waterfront, Long Canyon, Mesa Park, Move-Up Investor, Priced Below Market, Real Estate, River Place, Steiner Ranch, tarrytown

Dear Marketplace fans,

It’s been a long time since the Austin Real Estate market has ended on a high point—4 years to be exact. This past December, homes sales were up 1.36%. We haven’t been able to say that sales were up in six months.

2010 was a year of high points and low points. Normally, steady growth is the name of the game for Austin. However, we ran across something that we haven’t ever seen before—the Tax Credit. Never in the history of real estate has the government gone so far to try to stimulate the market by making cash payouts for buying a home.

The good news is that the first two quarters of the year were record setting. Sales were up, prices were solid and the market thrived. The bad news is what happened directly after the stimulus went away. Sales dipped dramatically; down an average of 28.33% per month for the next five months. Every positive effect of the Tax Credit was over-shadowed by this decline.

At the beginning of 2011, consumer confidence is on the rise and so are sales. As we soften back down to a normal, balanced market, there are a few key factors we need to watch going into the new year.

Job Growth— With the elections behind us, the stock market up and corporations sitting on more cash than ever, look for hiring to be on the rise and with that the sale of homes. Austin had positive job growth in 2010, and it will continue into 2011. Look for more people to relocate to Austin than ever before because of the favorable business climate, quality of life and unprecedented publicity.

Real Estate Investment— Austin wasn’t immune to the mortgage crisis and whether you realize it or not, homes are being foreclosed on in your neighborhood. Approximately 15% of all real estate sales in Austin were in a distressed situation. The silver lining to this tragedy is the market is set for investors to see tremendous cash flow and ROI in 2011. Investors will turn around and stabilize the real estate market. It is not only the professional investors, it’s the everyday—-saving for their kids to go to college—investors that will make the difference.

See the rest of our extensive report for an in-depth look at the Austin real estate market in 2010.

Make it a productive and prosperous 2011!

Best,

Laura

Download Market Report

Filed under Home Buying, Home Selling, Market Reports, Real Estate Investing, Real Estate Trends · Tagged with Austin, Market Report, Patrick Birdsong, Real Estate, Real Estate Investing, Selling Your Home, Texas

This a question that many Realtors are discussing across the country. The answer is somewhat shocking.

Denver, Colorado had as few as 1 in 4 homes sell, while Washington, DC had 6 out of 10 sell. As far as Austin, Texas goes… we are (in my opinion) the most stable real estate market in the country. We have job growth, we have a strong economy… the list goes on. And how does our sales numbers compare to the rest of the economy? Watch the video and read below to find out.

Recently, I was involved in a poll asking Realtors around the country how many homes actually sold in their markets in 2010. See below for a list of cities that had responses:

Knox County, Ohio – 42.54%

Wasilla, Alaska – 38%

Liberty Hill, Texas – 42.45%

Door County, Wisconsin – 25%

York County, South Carolina – 63%

Denver, Colorado – 25%

St. Louis, Missouri – 45.14%

Memphis, TN – 34%

Indianapolis, Indiana – 33.5%

Washington, DC – 63%

Montgomery, Alabama – 43.9%

Chicago, Illinois – 21%

Anoka County, Minnesota – 46.49%

Los Angeles, California – 43.1%

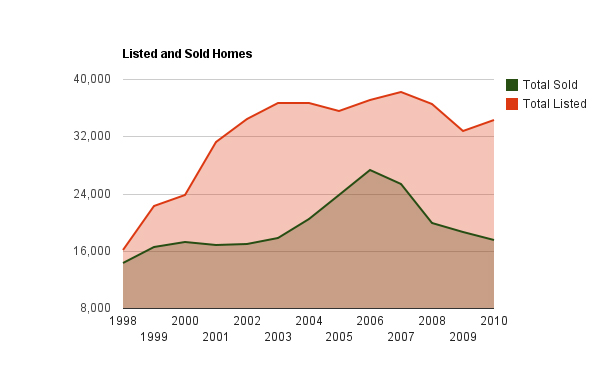

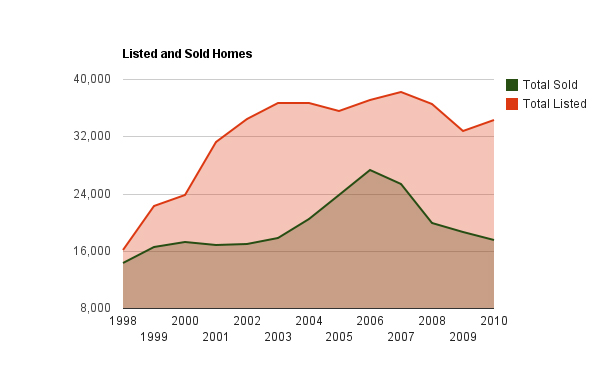

Austin, Texas falls right in the middle…. 51.17%

For every 2 homes that were listed in 2010, 1 SOLD!

See the chart below for the trends over the last 12 years.

If you are considering selling in 2011, join us for our FREE webinar on “How to Sell in a Down Market”. More information below:

Central Texas ranked 4th ‘most secure’ area in the United States for people to live.

According to Farmers Group Inc. Austin Ranked 4th in ‘secure’ places to live based on crime, weather, risk of natural disasters, housing depreciation, foreclosures, air quality, terrorist threats, environmental hazards, life expectancy and job loss statistics.

Thanks to Austin Police Chief Art Acevedo and his superb police force, safety and security are a priority in Austin. People continue to move to Austin because of our exceptional quality of life, excellent schools, the entrepreneurial spirit, an abundance of opportunities to enjoy the arts and a stable business climate.

Click here to read the full article in the Austin Business Journal.

Filed under Austin Living, Real Estate Trends, Relocation · Tagged with Austin, Business, city, crime, police, Real Estate, safe, schools, secure

« Previous Page — Next Page »